For essentially the most half, the world of non-public finance is calm and picked up. There’s not a whole lot of bickering. Writers (and readers) agree on most ideas and most options. And after we do disagree, it’s typically as a result of we’re coming from totally different locations.

Take getting out of debt, as an illustration. That is a kind of subjects the place individuals do disagree — however they disagree politely.

Hardcore numbers nerds insist that in case you’re in debt, you should repay high-interest obligations first. The maths says that is the neatest path. Folks, together with me, argue that different approaches are legitimate. You would possibly repay money owed with emotional baggage first. And many individuals would profit from repaying debt from smallest stability to highest stability — the Dave Ramsey strategy — moderately than specializing in rates of interest.

That mentioned, some cash subjects may be very, very contentious.

Any time I write about cash and relationships (particularly divorce), I do know the controversy will get full of life. Do you have to hire a house or do you have to purchase? That query will get individuals fired up too. What’s the definition of retirement? Do you have to hand over your automobile and discover one other solution to get round?

However out of all of the subjects I’ve ever coated at Get Wealthy Slowly, maybe essentially the most incendiary has been taxes. Folks have a whole lot of deeply-held beliefs about taxes, they usually don’t respect once they learn information that contradicts these beliefs. Chaos ensues.

Tax Details

Once I do write about taxes — which isn’t typically — I attempt to persist with info and avoid opinions. Examples:

- The U.S. tax burden is comparatively low when in comparison with different nations.

- The U.S. tax burden is comparatively low when in comparison with U.S. tax burdens prior to now.

- Total, the U.S. has a progressive tax system. Individuals who earn extra pay extra. That mentioned, sure taxes are regressive (that means that, as a share of earnings, low earners pay extra).

- Numerous People (roughly one-third) pay no federal earnings tax in any respect.

- Regardless of fiery rhetoric, nobody political celebration is best with taxing and spending than the opposite. The one interval throughout the previous fifty years through which the U.S. authorities had a finances surplus was 1998-2001 beneath President Invoice Clinton and a Republican-controlled Congress.

Even once I state these info, there are individuals who disagree with me. They don’t agree that these are info. Or they don’t agree these info are related.

Additionally, I generally learn complaints that the rich are taxed an excessive amount of. To make their argument, writers make statements like, “The highest 50% of taxpayers pay 97% of all federal earnings taxes.” Whereas this assertion is true, I don’t really feel prefer it’s a real measure of the place tax burdens fall.

I imagine there’s a greater, extra correct solution to analyze tax burdens.

Efficient Tax Burden

To me, what issues greater than nominal tax {dollars} paid is every particular person’s efficient tax burden.

Your efficient tax burden is normally outlined as your complete tax paid as a share of your earnings. When you take each tax greenback you pay — federal earnings tax, state earnings tax, property tax, gross sales tax, and so forth — then divide this complete by how a lot you’ve earned, what’s that share?

This morning, whereas curating hyperlinks for Apex Cash — my second personal-finance website, which is dedicated to sharing high cash tales from across the net — I discovered an attention-grabbing infographic from Visible Capitalist. (VC is a superb website, by the way in which. Find it irresistible.) They’ve created a graphic that visualizes efficient tax charges by state.

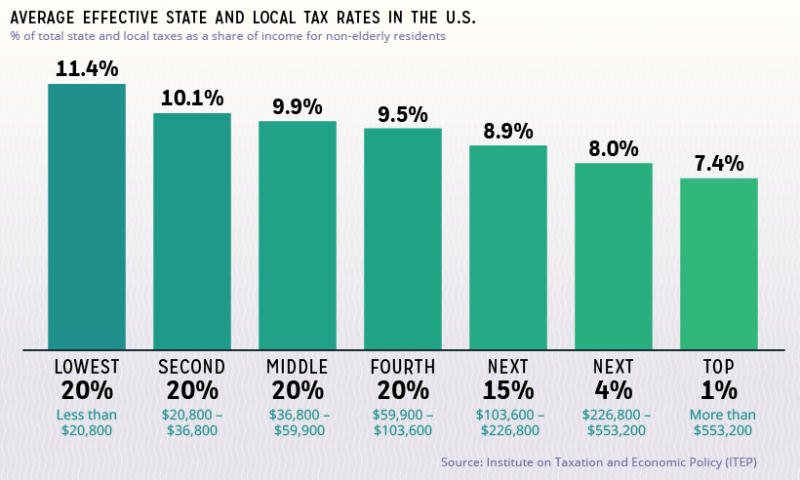

Right here’s a abstract graph (not the principle visualization):

As you’ll be able to see, on common the highest 1% of earnings earners within the U.S. have a state efficient tax fee of seven.4%. The center 60% of U.S. staff have a state efficient tax fee of round 10%. And the underside 20% of earnings earners (which Visible Capitalist incorrectly labels “poorest People” — wealth and earnings are not the identical factor) have a state efficient tax fee of 11.4%.

Tangent: This conflation of wealth with earnings continues to grate on my nerves. I’ll grant that there’s most likely a correlation between the 2, however they’re not the identical factor. For the previous few years, I’ve had a low earnings. I’m within the backside 20% of earnings earners. However I’m not poor. I’ve a web price of $1.5 million. And I do know loads of individuals — hey, brother! — with excessive incomes and low web worths.

It’s vital to notice — and this triggered me confusion, which meant I needed to revise this text — that the Visible Capital numbers are for state and native taxes solely. They don’t embody federal earnings taxes. (Coincidentally, I made an identical mistake a decade in the past when writing about marginal tax charges. I needed to make corrections to that article too. Sigh.)

GRS readers rapidly helped me treatment my mistake, pointing to the nonprofit Tax Basis’s abstract of federal earnings tax knowledge. With a little bit of detective work, I uncovered this graph of federal efficient tax charges by earnings from the Peter G. Peterson Basis. (Come on. What dad or mum names their child Peter Peterson? That’s imply.)

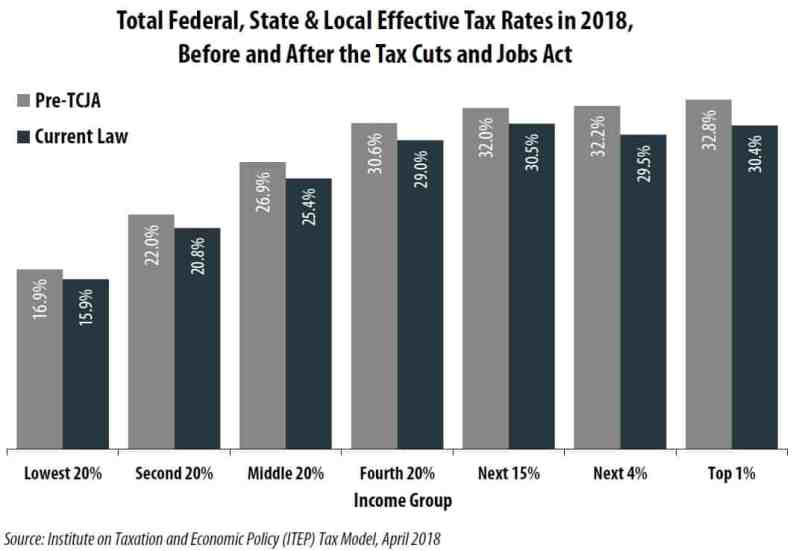

Let’s put this all collectively! In accordance with the Institute on Taxation on Financial Coverage, this graph represents complete efficient tax charges for folk of varied earnings ranges. Notice that this graph is explicitly evaluating projected numbers in 2018 for a) the present tax legal guidelines (in blue) and b) the earlier tax legal guidelines (in gray).

Complete Tax Burden vs. Complete Revenue

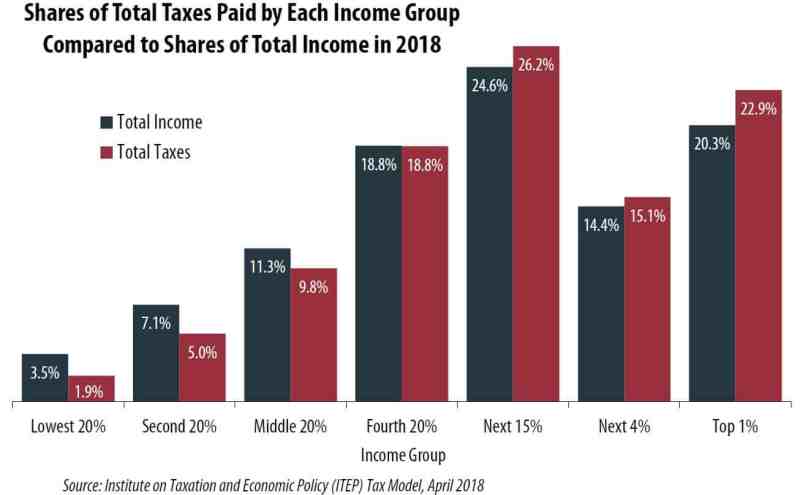

Right here’s one ultimate graph, additionally from the Institute on Taxation and Financial Coverage. That is the graph that I personally discover essentially the most attention-grabbing. It compares the share of complete taxes paid by every earnings group to their share of the nation’s complete earnings.

Collectively, the underside 20% of earnings earners in america earned 3.5% of complete earnings. They paid 1.9% of the entire tax invoice. The highest 1% of earnings earners within the U.S. earned one-fifth of the nation’s complete private earnings. They paid 22.9% of complete taxes.

Is the U.S. tax system truthful? Ought to individuals with excessive incomes pay extra? Do they pay greater than their fair proportion? Ought to low-income staff pay extra? Are we speaking about numbers which can be so shut collectively that it doesn’t matter? I don’t know and, in truth, I don’t care. I’m involved with private finance not politics. However I do care about info. And civility.

The issue with discussions about taxation is that folks discuss various things. When some people argue, they’re speaking about marginal tax charges. Others are speaking about efficient tax charges. Nonetheless others are speaking about precise, nominal numbers. When some individuals discuss wealth, they imply earnings. Others — appropriately — imply web price. It’s all very complicated, even to sensible individuals who imply nicely.

Ultimate Notice

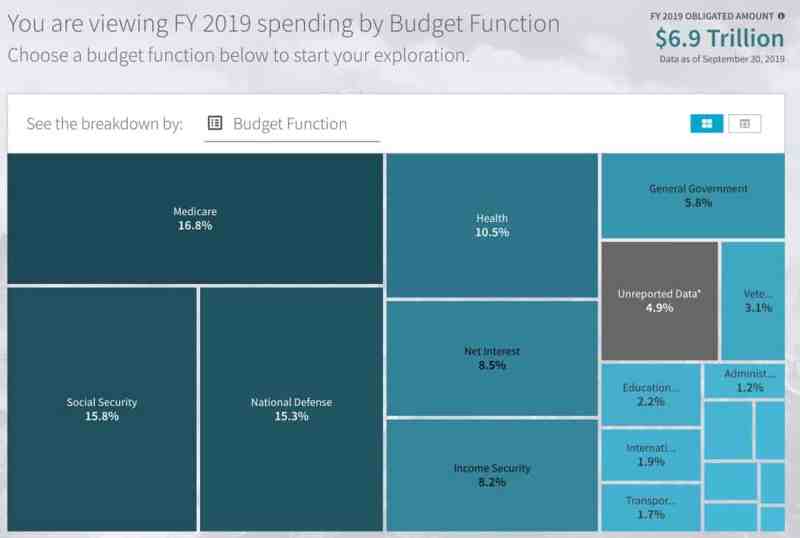

Beneath the Digital Accountability and Transparency Act of 2014, the U.S. Division of the Treasury was required to determine a web site — USASpending.gov — to offer the American public with information on how the federal authorities spends its cash. Whereas the usability of the location might use some work, it does present a whole lot of data, and I’m certain it’ll turn out to be one in all my go-to instruments when writing about taxes. (I intend to replace a few my older articles this yr.)

The USA Spending website has a Knowledge Lab that’s at the moment in public beta-testing. This subsite offers even extra methods to discover how the federal government spends your cash. (I additionally discovered one other easy budget-visualization instrument from Brad Flyon at Be taught Without end Be taught.)

Okay, that’s all I’ve for at the moment. Let the bickering start!